Irs Standard Deduction 2025 Married Joint

Irs Standard Deduction 2025 Married Joint. A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year. For the 2025 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for those filing separately.

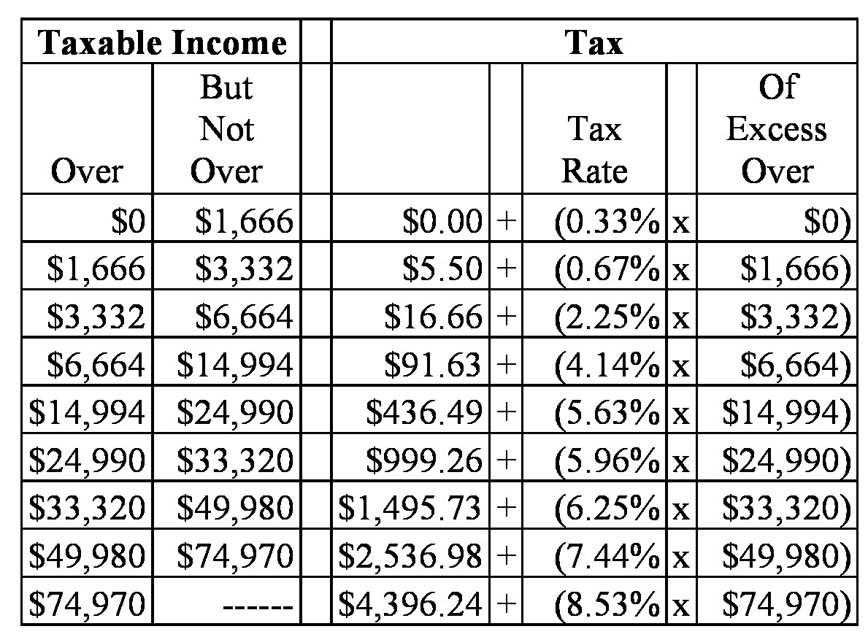

A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year. Income tax brackets have been updated for 2025, affecting taxpayers at different income levels.

Irs Brackets 2025 Married Jointly Lusa Nicoline, In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700). That’s the 2025 regular standard deduction of $29,200 for married taxpayers filing joint returns, plus three additional standard deductions at $1,550.

Tax Brackets 2025 Married Jointly Irs Standard Deduction Gray Phylys, This higher deduction lowers your taxable income, potentially placing you in a lower tax bracket and reducing your overall tax liability. Married filing joint 2025 standard deduction.

Irs 2025 Standard Deductions And Tax Brackets Allsun Annabella, You deduct an amount from your income before you calculate taxes. For the 2025 tax year (for forms you file in 2025), the standard deduction is $13,850 for single filers and married couples filing separately, $27,700 for married couples filing jointly and.

Standard Deduction For 2025 Tax Year Over 65 Katee Ethelda, It will rise to $29,200, up from $27,700 in 2025 for married couples filing jointly, amounting to a 5.4% bump. The top tax rate will remain at 37% for married couples filing jointly, however the income bracket has increased from $693,750 in 2025 to $731,200 in 2025.

2025 Standard Deduction Over 65 Single Aeriel Coralyn, This deduction also cannot be claimed if modified adjusted gross income exceeds the annual limits. Income tax brackets have been updated for 2025, affecting taxpayers at different income levels.

Standard Deduction Married 2025 Mady Karlie, It can also increase consumer. For instance, the 37% tax rate now applies to individuals.

2025 Standard Deduction Over 65 Married Filing Jointly Renie Charmain, Here’s how that works for a single person earning $58,000 per year: A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year.

2025 Tax Brackets And Standard Deduction Tracy Harriett, For a single taxpayer, the rates are: A super senior citizen is an individual resident who is 80 years or above, at any time during the previous year.

Potentially Bigger tax breaks in 2025, For individuals, the new maximum will be $14,600 for 2025, up from $13,850, the. 2025 tax rates for a single taxpayer.

Irs Standard Deduction 2025 Married Over 65 Ursa Tiffanie, For the 2025 tax year, the standard deduction for married couples filing jointly is $27,700, nearly double the $13,850 deduction for those filing separately. For 2025 (tax returns typically filed in april 2025), the standard deduction amounts are $14,600 for single and for those who are married, filing separately;

In 2025, it is $14,600 for single taxpayers and $29,200 for married taxpayers filing jointly, slightly increased from 2025 ($13,850 and $27,700).