Pt Annual Return Due Date Karnataka 202425

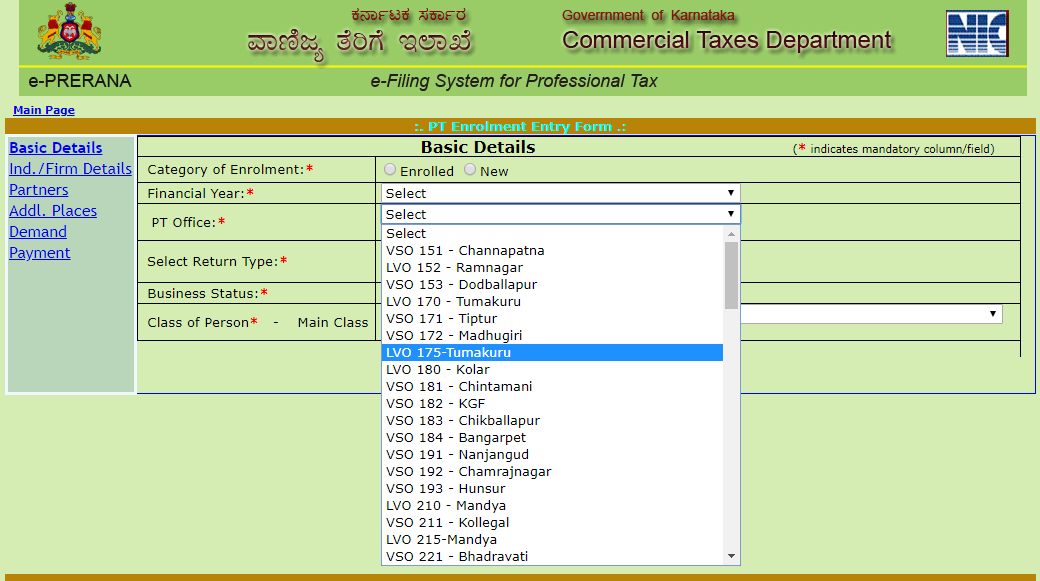

Pt Annual Return Due Date Karnataka 2025-25. Get accurate professional tax slab rate for karnataka & other details like pt act, rule, filing of returns, p tax registration, due dates, pt deduction, pt exemption, pt challan & latest. Provides a comprehensive guide to navigate the karnataka tax on profession, trades, callings, and employments (amendment) act, 2025.

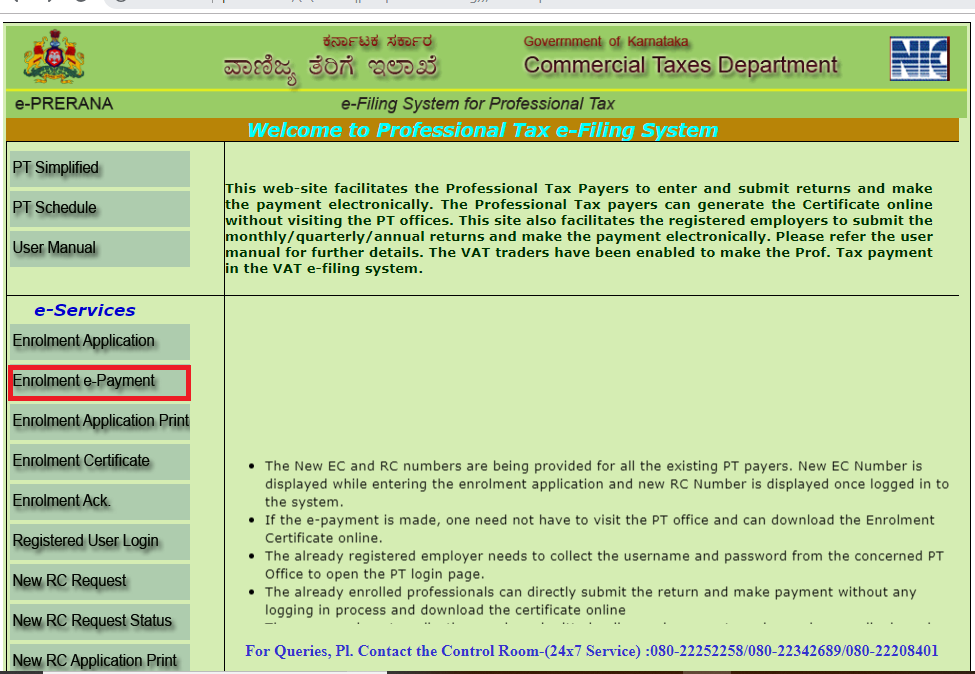

The government has issued the karnataka tax on professions, trades, callings and employment (removal of difficulties) order, 2025 to further amend the karnataka tax on. Powered by national informatics centre, bangalore.

Karnataka Professional Tax Return Filing Process Professional Tax, Use this calendar to keep tabs on all your compliances and stay on top of.

Karnataka Professional Tax Slab Rates How to Register and Pay Online?, Use this calendar to keep tabs on all your compliances and stay on top of.

Karnataka Annual PT Payment & Return filing Live in Kannada (ಕನ್ನಡದಲ್ಲಿ, For enrolments done after may 31st, the payment deadline is 30 days following the enrolment date.

Karnataka Professional Tax Slab Rates How to Register and Pay Online?, The payment deadline is june 30th if the organisation registers before may 31st.

2025 Quarterly Estimated Tax Due Dates In India Maire Roxanne, Get accurate professional tax slab rate for karnataka & other details like pt act, rule, filing of returns, p tax registration, due dates, pt deduction, pt exemption, pt challan & latest.

2025 Gst Dates Tildy Loella, For more information please see the videos provided under the menu 'help→videos'.

Tax Return Due Date For Ay 202425 202425 Date Cinda Delinda, The tax amount is ₹200 per month for employees earning at least ₹15,000.

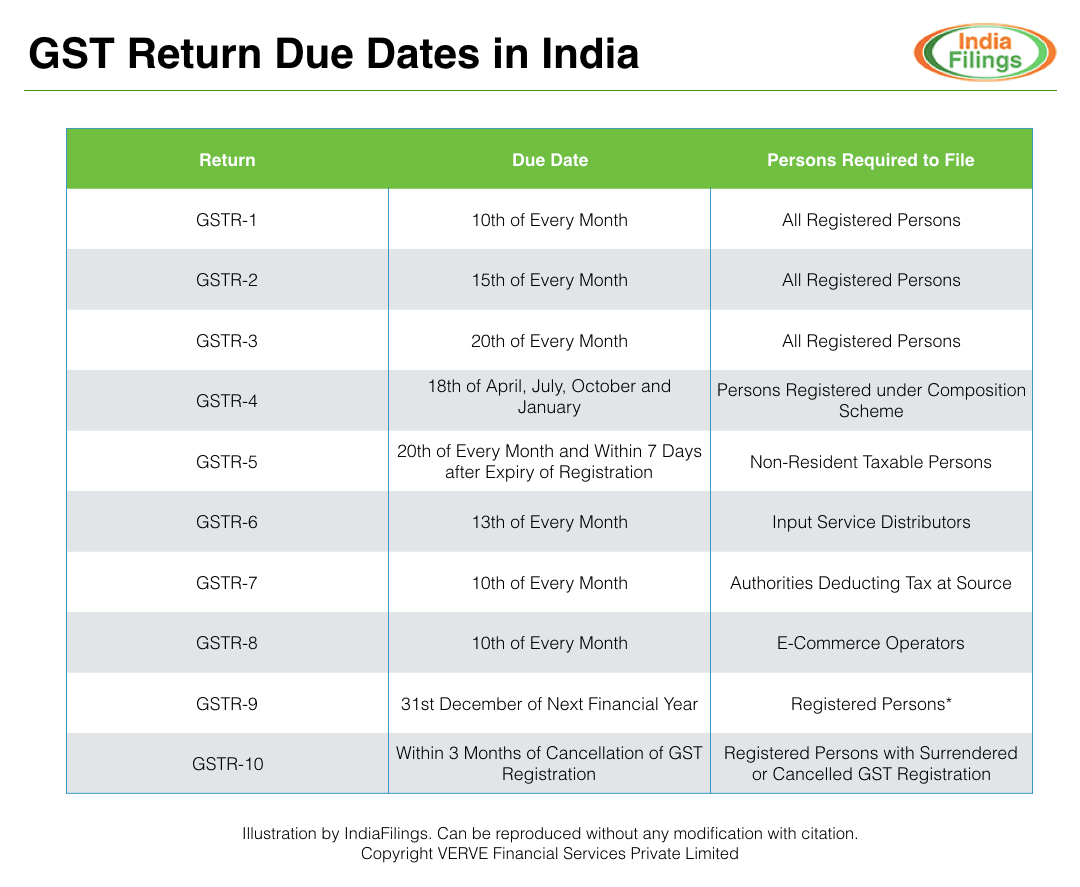

GST Annual Return Due Dates FinancePost, Get accurate professional tax slabs for all states in india & other details like pt act, rule, filing of returns, p tax registration, due dates, pt deduction, pt exemption, pt challan & latest.

Professional tax in Karnataka Registration and process Enterslice, Use this calendar to keep tabs on all your compliances and stay on top of.